Disney Parks & Experiences Report $8.3 Billion in Revenue for Q2 2024

The Walt Disney Company (NYSE: DIS) released its second-quarter earnings for the period ending March 30, 2024.

Key Takeaways:

- Revenue Growth: The company experienced a positive trend with revenues increasing to $22.1 billion from $21.8 billion in the same quarter last year.

- Earnings per Share (EPS): Diluted EPS saw a significant decline, shifting from a profit of $0.69 to a loss of $0.01. This decrease is primarily attributed to goodwill impairments, which were partially offset by gains in operating income for the Entertainment and Experiences segments.

- Non-GAAP EPS (Excluding Certain Items): When excluding one-time charges, diluted EPS rose to $1.21 compared to $0.93 in the prior year, reflecting a positive underlying performance.

Related – After 25 Years Star Wars Phantom Menace Makes Almost $15 Million at the Box Office

Key Points:

- In the second fiscal quarter of 2024, we achieved strong double-digit percentage growth in adjusted EPS, and met or exceeded our financial guidance for the quarter.

- As a result of our outperformance in the second quarter, our new full-year adjusted EPS(1) growth target is now 25%.

- We remain on track to generate approximately $14 billion of cash provided by operations and over $8 billion of free cash flow(1) this fiscal year.

- We repurchased $1 billion worth of shares in the second quarter and look forward to continuing to return capital to shareholders.

- The Entertainment Direct-to-Consumer business was profitable in the second quarter. While we are expecting softer Entertainment DTC results in Q3 to be driven by Disney+ Hotstar, we continue to expect our combined streaming businesses to be profitable in the fourth quarter, and to be a meaningful future growth driver for the company, with further improvements in profitability in fiscal 2025.

- Disney+ Core subscribers increased by more than 6 million in the second quarter, and Disney+ Core ARPU increased sequentially by 44 cents.

- Sports operating income declined slightly versus the prior year, reflecting the timing impact of College Football Playoff games at ESPN, offset by improved results at Star India.

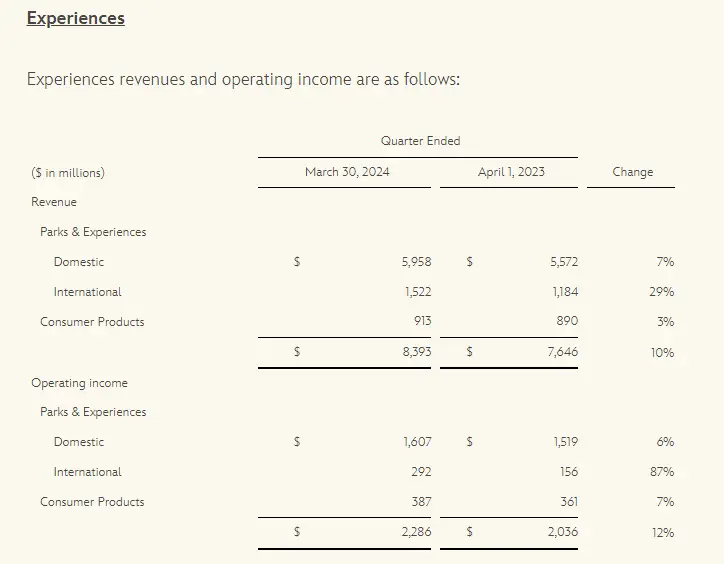

- The Experiences business was also a growth driver in the second quarter, with revenue growth of 10%, segment operating income growth of 12%, and margin expansion of 60 basis points versus the prior year. Although the third quarter’s segment operating income is expected to come in roughly comparable to the prior year, we continue to expect robust operating income growth at Experiences for the full year.

“Our strong performance in Q2, with adjusted EPS up 30% compared to the prior year, demonstrates we are delivering on our strategic priorities and building for the future,” said Robert A. Iger, Chief Executive Officer, The Walt Disney Company. “Our results were driven in large part by our Experiences segment as well as our streaming business. Importantly, entertainment streaming was profitable for the quarter, and we remain on track to achieve profitability in our combined streaming businesses in Q4.

“Looking at our company as a whole, it’s clear that the turnaround and growth initiatives we set in motion last year have continued to yield positive results. We have a number of highly anticipated theatrical releases arriving over the next few months; our television shows are resonating with audiences and critics alike; ESPN continues to break ratings records as we further its evolution into the preeminent digital sports platform; and we are turbocharging growth in our Experiences business with a number of near- and long-term strategic investments.”

Domestic Parks and Experiences

The increase in operating income at our domestic parks and experiences was due to higher results at Walt Disney World Resort and Disney Cruise Line, partially offset by lower results at Disneyland Resort.

- At Walt Disney World Resort, higher results in the current quarter compared to the prior-year quarter were due to:

- Increased guest spending attributable to higher average ticket prices

- Higher costs due to inflation, partially offset by lower depreciation and cost saving initiatives

- Growth at Disney Cruise Line was due to an increase in average ticket prices, partially offset by higher costs

- The decrease in operating results at Disneyland Resort was due to:

- Higher costs driven by inflation

- An increase in guest spending attributable to higher average ticket prices and daily hotel room rates

- Higher volumes due to attendance growth, partially offset by lower occupied room nights

International Parks and Experiences

Higher international parks and experiences’ operating results were due to:

- An increase in operating results at Hong Kong Disneyland Resort attributable to:

- Guest spending growth due to increases in average ticket prices and food, beverage and merchandise spending

- Higher volumes resulting from increases in attendance and occupied room nights. Volume growth benefitted from additional days of operations in the current quarter as well as the opening of World of Frozen in November 2023

- Increased costs driven by inflation and new guest offerings

You can read more from the Second Quarter and Six Months Earnings for Fiscal 2024 report here.

Let our friends at Destinations to Travel help you book your next Disney Vacation. They are the preferred Travel Agency of Chip and Company and Disney Addicts, and who we use ourselves.

Get started below for your FREE No Obligation Quote.

Book With our friends at Destinations to Travel

For the BEST in Disney, Universal, Dollywood, and SeaWorld Theme Park News, Entertainment, Merchandise & More follow us on, Facebook, Instagram, and Youtube. Don't forget to check out the Chip and Company Radio Network too!